Never Lose Money

When a person starts to invest, it seems obvious that the objective should be to make as much money as possible. This can lead to first time investors becoming blind to the risks that they’re taking so that they can earn higher returns. Like many things in life, this is a problem that needs to be inverted. Instead of asking how can I earn higher returns, investors first need to ask how can I avoid losing money?

Warren Buffett stated this principle elegantly: “Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1.”

The thought behind this approach to investing is that if you focus on the downside, then the upside will take care of itself. Stated another way, if you can minimize the risk in your investments such that the downside is limited, the only other direction is up — which means you’re making money and at low risk.

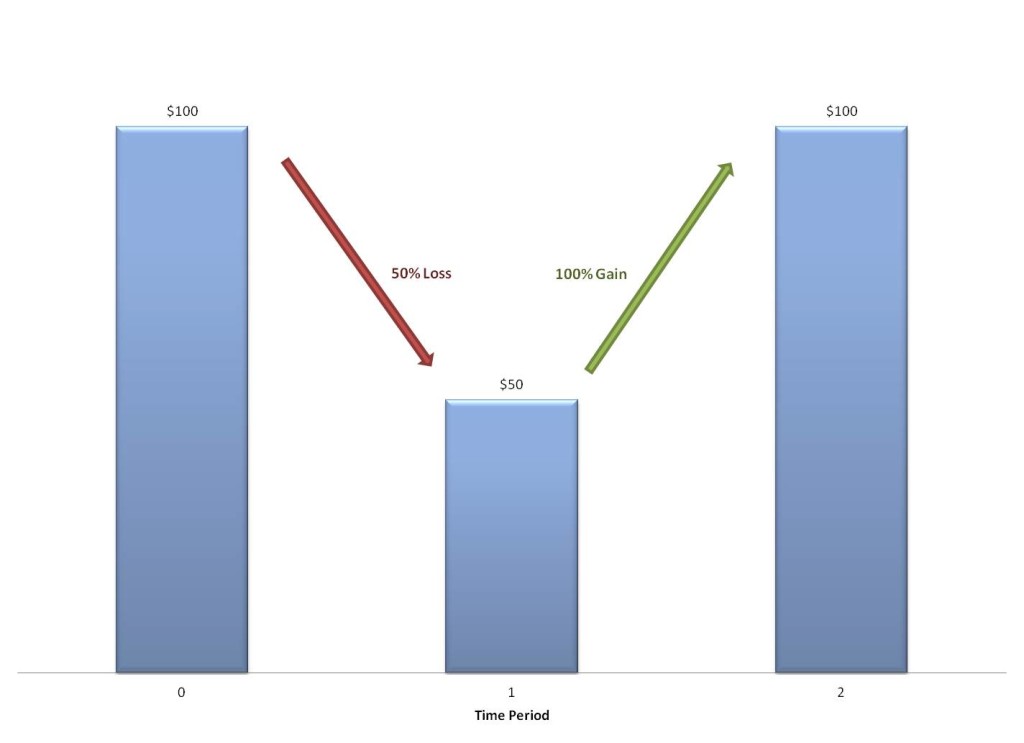

The math behind this concept is simple, but very powerful. If you have $100 invested into a security, and that security loses half its value, you would be left with $50. In order to get back to breakeven, that $50 needs to grow back into $100. So, if you lose 50% of your original investment, you will need a 100% return just to get back to breakeven. See picture below. That’s not the kind a math that I like. For me, it is much easier to try to avoid losses and make good returns, then to lose a whole bunch of money and have to hit a bunch of home runs afterward just to catch up.

Let’s look at one more example. Let’s pretend that there are two people who both have $100 investments. After one year, the first person has earned 7% on his investment, and the second person has lost 50% of his investment. From that time forward, the first person earns 7% per year. Below is a table showing how many years it will take for the second person’s investment to catch up to the first person’s investment under various return scenarios. As you can see, if the second person earns 40% per year after the loss, his investment won’t catch up with the first person’s investment until just before year 4. If the second person earns 30% per year after the loss, his investment won’t catch up until around year 5. Finally, if the second person earns 20% per year after the loss, his investment won’t catch up until just before year 8. So, even under an extremely optimistic return scenario of 40%, the second person’s investment wouldn’t catch up to the first person’s investment until just before year 4. And under the slightly less optimistic return scenario of 20%, it would take almost 8 years to catch up. And there’s no guarantee that this second investor could achieve even close to 20% per year for that amount of time. See graph below.

Let’s take this concept to the extreme. Let’s pretend you have a string of fantastic investment successes where you’ve grown your money to 100 times what it used to be. And let’s say you invest that money into something that turns out to be a complete loss. At that point, all of your previous investment successes don’t matter, because you have no money now. In other words, it’s critical that you remember that any number times zero equals zero.

Now, I’m not saying you shouldn’t invest in situations that have some amount of risk. All investments have risk. What I’m advocating is that you 1) become extremely aware of what you’re doing with every single investment, 2) make sure all your investments compensate you for the risks you’re taking, and 3) size your investments appropriately so that you can handle any losses that come your way.